As I’ve said before, the reason for this project of mine is that I feel there are some things missing from the current landscape of personal finance education and discussion out there. My goal is to fill that void and bring what I found missing to this forum.

Here are some examples of what I think needs to be focused on far more often.

The Use of Data

Milestones – an action or event marking a significant change or stage in development

- Wealth Stages:

- What are the standard stages of wealth that mark fundamental shifts in investing process, strategy, risk, etc.

- Universally accepted milestones and targets that can be scaled and compared across users

- Targets

- Ratios as a means of setting targets to strive for in PF activities

- Criteria for decision making

- Don’t blindly accept common advice… (buy a house). I say run the numbers.

Graded Levels of information

- Beginner

- Intermediate

- Advanced

- Insider

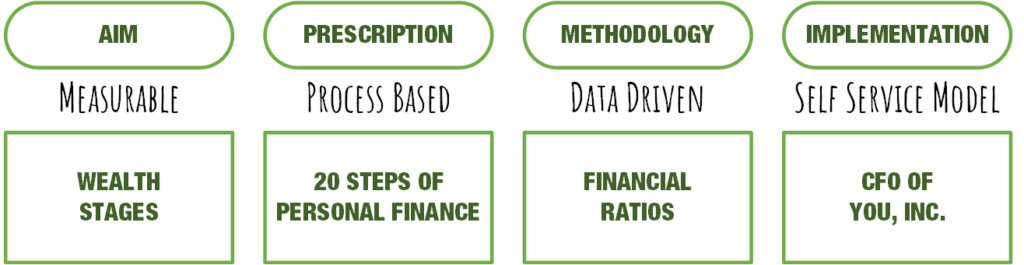

Focus on Process

- Your process should different by degree, not by kinds. Do same things, just different numbers.

- Your Process should be data driven:

- Definable

- Measurable

- Repeatable

- Comparable

Crossover Point

- You and your life

- Monthly investment income becomes great3ed than monthly expense

- Problem: Years or decades in the future. Needed additional and earlier, clear and definable milestones

- Wealth Stages

Models

For evaluating your financial fitness. Also comparing yours to others and attempt to set a standard / benchmarks.

- Model #1: Multiples of income vs expenses

- Characterization of active vs passive

- Model #2: Financial Ratios

- Model #3: Competency in various financial based skills

- Stock evaluation

- Excel

- Math

- Real Estate investing

- Model #4: Exposure across various investment and income producing strategies

- Stocks, bonds, real estate, private, etc.

- Multiple streams of income

- Reduced risk exposure

Note: It is very possible that I just never saw what I was looking for and it was out there all along. That said, if I haven’t heard about it after looking for it for a few years, I assume there is a need for me to put it out there. If I’m duplicating others work, well, it’s good for the knowledge to be out there in multiple places. If what I’m putting out sucks in comparison, let me know and I’ll adjust. Like I say, this is what I do. I’m a dude, not a doctor. If you find something valuable here, take it and use it. If not, that’s cool too.

Article 00 002

Leave a Reply