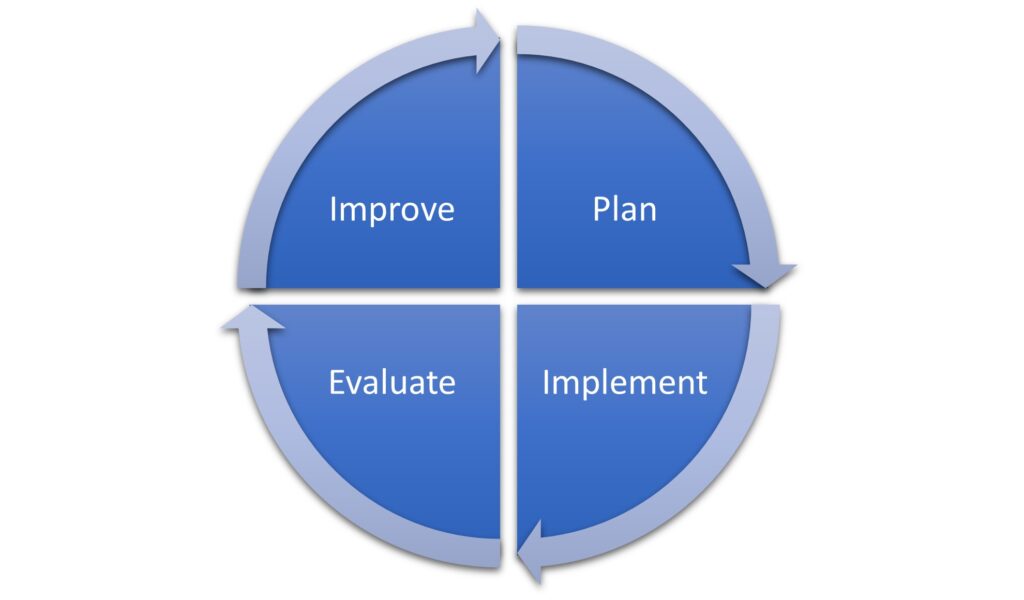

These steps are meant to be taken as a cyclical process, to be continuously evaluated, refined, adjusted and repeated.

The previous 19 steps i’ve outlined are not meant to be done just once. This 20 step process is not a ‘set it and forget it’ procedure. It’s designed as an iterative3 process. It’s designed to be done, multiple time, over multiple years, as you move through the various stages in your personal finance journey.

Again, these are the basics. The minimum required. The things everyone should be doing at the very least to insure they are on a solid path towards financial security and hopefully, freedom. How we define these terms is for another day. Suffice it to say, that as you move through life, maintaining a solid hold on these 20 steps should help you be successful in your finances.

Plan

- Identify your current position financially

- analyze the challenges you face

- Common challenges

- unique to you challenges

- Identify goals you are attempting to achieve

- Specify what your primary vs secondary goals

- Net Worth goal

- Net Income/Cash Flow goal

- Create milestones goals and objectives,

- Create evaluation plans and processes

- Learn best practices, strategies and tactics used by others who are successful

- Develop an action plan

Implement

- Do the work.

- Follow the process

- Document challenges, successes, failures and lessons learned

Evaluate

- Constantly evaluate short, medium and long term outcomes

- Decide on process and outcome measures

- Identify outcomes of interest

- Again, constantly evaluate and monitor with feedback

Improve

- adjust plans, strategies, tactics and even goals to account for lessons learned

?

JvZlOw sgoSFW kCZAvXoa IVAB JTmc oAz

Идеальные источники бесперебойного питания для дома, в обзоре.

Обзор источников бесперебойного питания, ознакомьтесь.

Преимущества использования ИБП, в этой статье.

Как выбрать ИБП для вашего оборудования, читайте.

Как выбрать идеальный источник бесперебойного питания, узнайте.

Покупка ИБП: на что обратить внимание, узнайте.

Источники бесперебойного питания: как выбрать лучший, узнайте.

Технические аспекты ИБП, на нашем сайте.

Как продлить срок службы источника бесперебойного питания, читайте.

Тенденции рынка источников бесперебойного питания, узнайте.

Правила подключения источника бесперебойного питания, в нашем гиде.

ИБП для дома и офиса: выбор и рекомендации, узнайте.

Инсайдерские советы по выбору источников бесперебойного питания, в статье.

Рейтинг популярных источников бесперебойного питания, читайте.

Пошаговая инструкция по установке ИБП, читайте.

Обзор популярнейших источников бесперебойного питания, в нашем блоге.

Устранение неисправностей ИБП, в нашем гиде.

Как выбрать ИБП для игры, узнайте.

Топ-10 источников бесперебойного питания на рынке, получите информацию.

купить ИбП http://istochniki-bespereboynogo-pitaniya.ru/ .

https://tokarnye-stanki-s-chpu.ru/ – учебный токарный станок с чпу — это современное оборудование для точной обработки металла и дерева.

Такое оборудование обеспечивает точное и быстрое изготовление деталей из различных материалов.

Автоматизация токарных работ минимизирует человеческий фактор и ускоряет выполнение задач. Подобные агрегаты востребованы в автомобильной, медицинской и энергетической сферах.

#### **2. Принцип работы токарных станков с ЧПУ**

Основой функционирования станка является программное управление, которое задает траекторию движения резца.

Система обратной связи позволяет корректировать работу станка в режиме реального времени. В результате производитель получает детали с минимальными допусками и высокой чистотой поверхности.

#### **3. Преимущества токарных станков с ЧПУ**

Основным преимуществом является возможность выполнения сложных операций без ручного вмешательства.

Программное управление минимизирует ошибки и повышает эффективность работы. Кроме того, станки с ЧПУ обладают гибкостью и могут быть быстро перенастроены под новые задачи.

#### **4. Перспективы развития токарных станков с ЧПУ**

Развитие технологии приведет к созданию более умных и автономных систем.

Внедрение интернета вещей (IoT) позволит удаленно контролировать производственные процессы. Это откроет новые возможности для промышленности и ускорит переход к «умным» заводам.

—

### **Спин-шаблон:**

#### **1. Введение в токарные станки с ЧПУ**

Современное производство сложно представить без токарных станков с ЧПУ. Такое оборудование обеспечивает точное и быстрое изготовление деталей из различных материалов.

Применение ЧПУ сокращает время производства и уменьшает количество брака. Сегодня станки с ЧПУ используются в машиностроении, авиации и других отраслях промышленности.

*(Шаблон продолжается аналогично для всех последующих разделов.)*

Получите профессиональную помощь на компания юридические услуги.

Консультация юриста – важный шаг для решения юридических вопросов. Юридическая помощь необходима в различных ситуациях, и важно правильно выбрать специалиста.

Первый этап – это определение типа юридической проблемы. В зависимости от сложности дела может потребоваться помощь адвоката или юриста, специализирующегося на конкретной области.

Важно найти квалифицированного специалиста, который может помочь в вашей ситуации. Обратите внимание на опыт и рекомендации.

Прежде чем пойти на встречу, стоит собрать все необходимые документы. Это поможет юристу быстро понять ситуацию и дать квалифицированные советы.

Если вам нужна бесплатная юридическая консультация, то специалисты на нашем сайте готовы помочь!

ресурс yuridicheskaya-konsultaciya101.ru предлагает профессиональные юридические услуги для компаний. Юристы, работающие с нами готовы оказать помощь в любой ситуации.

Мы уверены, что каждый пользователь уникален. Исходя из этого, мы настаиваем на индивидуальном подходе к каждому делу. Наши юристы тщательно изучает основные аспекты ситуации, чтобы предложить наилучший вариант.

Также мы предлагаем первичные консультации без оплаты для первичных клиентов. Так мы можем лучше разобраться в проблемы клиента и принять решения.

Процесс обращения к нам дает вам доступ к компетентным юристам, которые обладают глубокими знаниями законодательства. Мы гарантируем вы получите надежную юридическую помощь на всех этапах.

Получите бесплатную юридическую консультацию на сайте konsultaciya-yurista-msk01.ru, где профессиональные юристы готовы помочь вам в решении любых правовых вопросов.

Профессиональная консультация юриста — важный аспект для большинства граждан. В нашей организации доступен целый ряд юридических услуг, которые помогут вам в решении различных вопросов. С помощью наших специалистов вы сможете защитить свои права.

Все наши юристы обладают обширным опытом в различных юридических сферах. Каждый из них способен эффективно решать проблемы клиентов. Наши юристы ориентированы на оперативное решение ваших проблем.

Мы придерживаемся индивидуального подхода к нашим клиентам. Вы можете рассчитывать на детальное изучение вашей ситуации. Мы всегда стараемся предоставить максимально полную информацию о перспективах вашего дела.

Свяжитесь с нами, чтобы получить необходимую юридическую помощь. Мы заинтересованы в том, чтобы вы были уверены в нашей правовой поддержке. Мы стремимся к тому, чтобы ваши интересы были защищены на всех этапах.

Получите профессиональную бесплатную консультацию юриста и разрешите свои юридические вопросы с уверенностью!

Изучение отзывов и рекомендаций может помочь в выборе надежного юриста.

Получите бесплатную консультацию юриста по сложным вопросам прямо сейчас!

Статья на тему юридической консультации. Непонимание юридических нюансов может негативно сказаться на жизни граждан.

Первенствующий вопрос, который необходимо рассмотреть, — это доступ к юридическим консультациям. Сейчас существует много юристов, которые предлагают помощь дистанционно. Такой подход значительно облегчает получение правовой помощи.

Также важным аспектом является процесс выбора квалифицированного юриста. Подбор специалиста требует внимания к его квалификации и профессиональным достижениям. Люди часто игнорируют эти факторы, что может привести к неудачам.

Третий важный фактор — это цены на юридические консультации. Стоимость может зависеть от многих факторов, включая опыт специалиста и специфику вопроса. Обсуждение условий и стоимости заранее крайне важно.

Важно осознавать, что юрист несет ответственность за свои действия. Отсутствие должного уровня компетенции может иметь серьезные последствия для клиента. Выбор подходящего юриста критически важен для достижения положительных результатов.

Получите квалифицированную юридическую бесплатную консультацию онлайн.

Вы можете обратиться на yuridicheskaya-konsultaciya23.ru для получения ответов на ваши юридические вопросы.

Если вам нужна бесплатные консультации юриста онлайн без регистрации, не стесняйтесь обратиться к нам за помощью!

Опытные адвокаты из нашей юридической компании готовы помочь вам в решении различных правовых вопросов. У нас есть множество направлений работы , включая консультации, представительство в суде и помощь в составлении документов.

При обращении к нашим юристам, вы можете рассчитывать на индивидуальный подход . Каждый клиент для нас важен, и мы стремимся предложить максимально выгодные условия . Наша цель – помочь вам разобраться в сложной ситуации .

На нашем сайте вы можете узнать больше о нашей деятельности . Мы всегда стремимся предложить актуальные решения . Также у нас есть блоги с юридическими новостями , которые помогут вам быть в курсе последних изменений в законодательстве.

Связываясь с нашими специалистами , вы можете задать все интересующие вас вопросы. Мы готовы помочь вам по любым правовым вопросам. Мы ценим ваше время и желания.

В современном мире юридические консультации играют важную роль.. Множество людей сталкивается с юридическими вопросами, требующими консультации..

konsultaciya-advokata11.ru предлагает широкий спектр услуг.. На нашем сайте доступны услуги по самым разным направлениям права. Получите помощь квалифицированного юриста на юридические услуги онлайн бесплатно.

Профессиональные адвокаты готовы помочь вам.. Качество нашей работы – это наш главный приоритет.

Воспользуйтесь нашими услугами, и вы останетесь удовлетворены результатом.. Мы гарантируем профессионализм и индивидуальный подход к каждому клиенту..

Получите бесплатную юридическую консультацию онлайн, чтобы оперативно решить все ваши юридические вопросы!

На сайте konsultaciya-advokata91.ru широкий спектр юридических услуг.

Обратитесь за помощью к профессионалам на консультация юриста, и получите квалифицированное решение своих вопросов.

сайт yuridicheskaya-konsultaciya34.ru предлагает профессиональные юридические услуги, направленные на решение различных правовых вопросов. Группа квалифицированных специалистов готова помочь вам в самых сложных ситуациях. Понимая, что правовые проблемы могут быть стрессовыми, мы предлагаем внимательное отношение к каждому клиенту.

Мы предлагаем широкий спектр услуг, включая консультации по гражданским и уголовным делам. Мы приглашаем вас по вопросам, связанным с трудовым правом, семейными делами и другими юридическими аспектами. Каждый случай уникален , и готовы предложить оптимальное решение.

Мы гордимся нашей репутацией как надежный партнер в сфере юриспруденции. Мы получаем положительные отзывы от клиентов за высокое качество обслуживания и результативность. Каждый юрист нашей команды имеет опыт работы в различных областях права и готов поддержать вас в любое время.

Не ждите, пока ситуация усугубится , чтобы получить квалифицированную юридическую помощь. Свяжитесь с нами для получения дополнительной информации. Юридическая консультация ждет вас на yuridicheskaya-konsultaciya34.ru.

Сайт konsultaciya-advokata51.ru предлагает вам разнообразные возможности. Юридическая консультация – это важный шаг для многих людей. Мы обеспечим вас экспертными консультациями.

Получите бесплатную юридическую консультацию круглосуточно на вопрос ответ юристу бесплатно.

Команда адвокатов постоянно повышает свою квалификацию.

Важно обратить внимание на уровень профессионализма юристов. Все адвокаты на нашем сайте имеют большой опыт работы. Мы стремимся обеспечить высокий уровень обслуживания.

Второй аспект – это доступность услуг. Вы сможете легко ознакомиться с нашими тарифами и предложениями. Мы уверены, что каждый найдет подходящее решение для себя.

Наши адвокаты готовы предоставить юридическую помощь в режиме онлайн. Виртуальные консультации становятся всё более популярными. Наши специалисты готовы ответить на ваши вопросы круглосуточно.

Получите бесплатную консультацию юриста по телефону на сайте бесплатный номер телефона юриста.

В современном мире юридические вопросы становятся все более сложными.

Первая стадия в решении вашего вопроса — это консультация с адвокатом.

Получите профессиональную помощь от юриста на юрист онлайн бесплатно.

Каждый клиент может надеяться на внимательное изучение его дела.

Получите бесплатную консультацию юриста онлайн Вопрос–ответ юристу бесплатно и быстро.

Важно использовать все доступные ресурсы для разрешения споров.

Бесплатная юридическая консультация в Москве становится все более популярной . Причиной этого является увеличившаяся необходимость в юридической поддержке . Специалисты готовы предоставить свои услуги безвозмездно .

Бесплатные юридические консультации должны быть доступны каждому желающему. Услуги юристов доступны для всех, кто нуждается в помощи. Это способствует уменьшению случаев юридических конфликтов.

Процесс получения бесплатной консультации обычно несложен . Чаще всего, чтобы получить помощь, нужно просто записаться к юристу. Некоторые организации предлагают консультации в режиме онлайн .

В заключение, бесплатные юридические консультации в Москве представляют собой значимую помощь для населения . Юридическая помощь также играет значительную роль в повышении правовой грамотности населения . Не стесняйтесь обращаться за помощью, если это необходимо .

информация тут https://seven.mixh.jp/answer/question/%d0%b1%d0%b5%d1%81%d0%bf%d0%bb%d0%b0%d1%82%d0%bd%d0%b0%d1%8f-%d0%bf%d1%80%d0%b0%d0%b2%d0%be%d0%b2%d0%b0%d1%8f-%d0%bf%d0%be%d0%bc%d0%be%d1%89%d1%8c-%d0%b0%d0%b4%d0%b2%d0%be%d0%ba%d0%b0%d1%82-%d0%b3/

Чтобы получить профессиональную помощь в вопросах раздела имущества, обратитесь к мировое соглашение раздел имущества, который поможет вам разобраться в вашей ситуации и защитить ваши интересы.

Таким образом, предприниматели могут быть уверены в актуальности предоставляемых данных.

Hey, I just stumbled onto your site… are you always this good at catching attention, or did you make it just for me? Write to me on this website — rb.gy/ydlgvk?nag — my username is the same, I’ll be waiting.

To learn more about our affordable advertising options and how they can benefit your website, visit https://rb.gy/ydlgvk?Rhimi today. Your success is our priority!

Получите бесплатную юридическую консультацию онлайн, чтобы оперативно решить все ваши юридические вопросы!

Каждая ситуация уникальна и требует индивидуального подхода, поэтому мы щепетильно изучаем каждое дело.

“Barely legal nymph wants to sin.” Click Here \u003e https://rb.gy/34p7i3?Rhimi

“Gorgeous nymphomaniac yearns for release.” Here — rb.gy/t0g3zk?nag

“Gorgeous nymphomaniac yearns for release.” Here — https://rb.gy/8rrwju?Rhimi

“Tempting tease longs for ecstasy.” Here — rb.gy/8rrwju?nag

This post really resonated with me. Keep up the good work.

Если вам необходима бесплатные юристы онлайн посетите этот ресурс.

необходима для того, чтобы защитить права и интересы клиентов. Это связано с тем, что многие люди сталкиваются с различными юридическими проблемами и нуждаются в помощи . Кроме того, юридическая консультация может помочь найти наиболее эффективные решения .

Юридическая консультация дает возможность решить любые юридические вопросы. Это особенно важно для людей, которые столкнулись с юридическими проблемами . Кроме того, может помочь клиентам найти наиболее эффективные решения.

# Раздел 2: Виды юридической консультации

Юридическая консультация может быть осуществлена через различные каналы. Это включает в себя личные встречи с юристом . Кроме того, юристы могут специализироваться в различных областях права .

Юридическая консультация может быть полезна для предотвращения потенциальных проблем . Это особенно важно для тех, кто нуждается в профессиональной помощи. Кроме того, может предоставить возможность получить необходимую поддержку и рекомендации .

# Раздел 3: Преимущества юридической консультации

Юридическая консультация предоставляет возможность получить профессиональную помощь и поддержку . Это связано с тем, что юрист может помочь клиентам вести переговоры и заключать контракты. Кроме того, может помочь клиентам найти наиболее эффективные решения.

Юридическая консультация может быть полезна для предотвращения потенциальных проблем . Это особенно важно для людей, которые столкнулись с юридическими проблемами . Кроме того, может предоставить возможность получить необходимую поддержку и рекомендации .

# Раздел 4: Заключение

Юридическая консультация играет решающую роль в большинстве юридических вопросов . Это связано с тем, что юридическая поддержка необходима для предотвращения потенциальных проблем. Кроме того, юрист может помочь клиентам вести переговоры и заключать контракты.

Юридическая консультация предоставляет возможность получить профессиональную помощь и поддержку . Это особенно важно для бизнеса, который только начинается . Кроме того, может помочь предотвратить потенциальные проблемы.

Lost in fantasies of your hands on my skin. – https://https://nMm5id.short.gy/jEMfCL?Rhimi