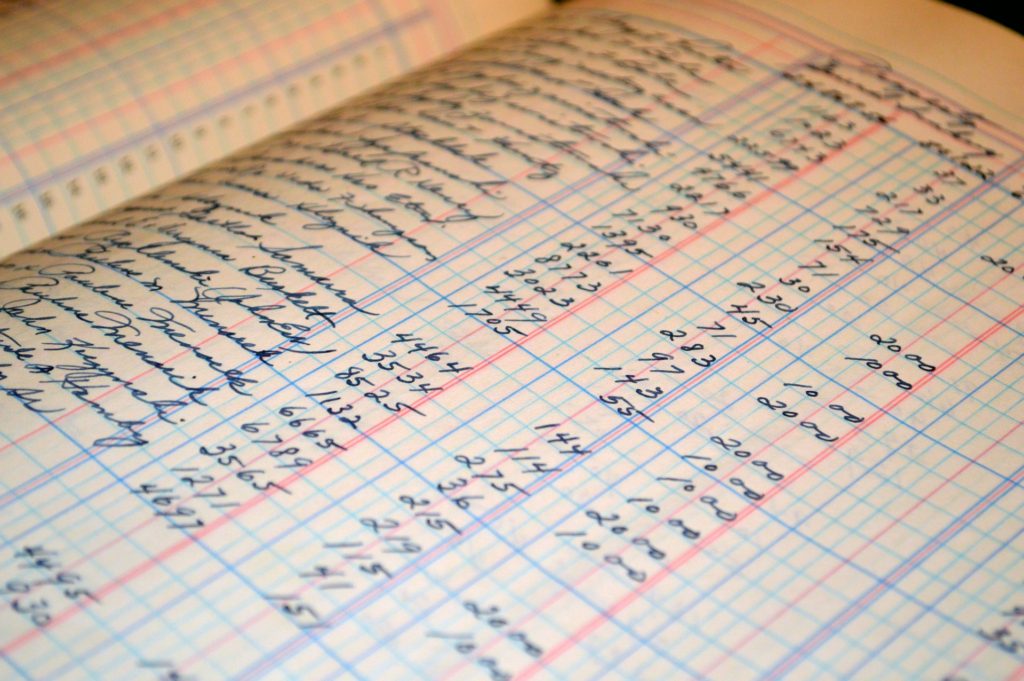

Using the same trip analogy, if the net worth is your location as you travel, your income on your “cash flow” statement is the speed you’re traveling. This is the second number you should be tracking. Taken together, your net worth and cash flow will help you benchmark your progress against others and yourself.

A positive cash flow number reveals that you are adding to your net worth each month, while a negative number indicates declining wealth. Increasing cash flow is the key to growing wealth – the means by which wealth is increased.

More importantly, these numbers are universally understood in the business world. They give you the vocabulary and common language to communicate with other professionals about your status and progress on your personal finance journey. Again, most people assume these numbers are just for businesses. Remember. You are a business. So do what businesses do!

- Take your net monthly income (what you earn after taxes are withheld)

- I personally start from gross income and then subtract taxes and expenses, so I can precisely account for taxes, deductions and 401k savings.

- Subtract your total monthly expenses (food, shelter, clothing, entertainment, saving, giving) from your net income

- Difference between income and expenses is cash flow.

Your goal is to “Grow the Gap” between income and expenses as large as possible.

- Get the Income as big as possible.

- Get the Expenses as small as possible.

The bigger the gap between your income and expenses, the more you’ll build wealth and the faster you’ll do it. It’s a very simple concept. The difficulty is in execution.

Do you have an income statement for your own finances? Let me hear from you.

Leave a Reply