One of the biggest problems I had when I was first starting my personal finance journey was figuring out what were ‘reasonable’ targets. I wanted a more definitive set of targets to strive for that also had a basis in real changes to one’s quality of life, stage of living, wealth position, etc.

I wanted these targets to be…

- comparable to others so that I can compare my progress to friends or mentors

- building to an overall framework that’s fits with my personal finance views and strategy

- relative to my income or income level so that it makes sense no matter how much one makes

- standard and easily calculated such that it only takes simple math

- flexible as my income, living situation, family composition, or other pertinent factors change, my targets could maintain the relevancy

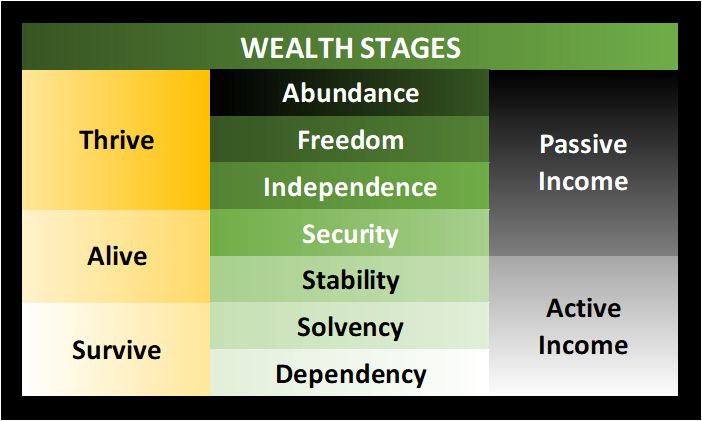

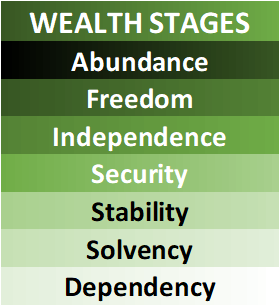

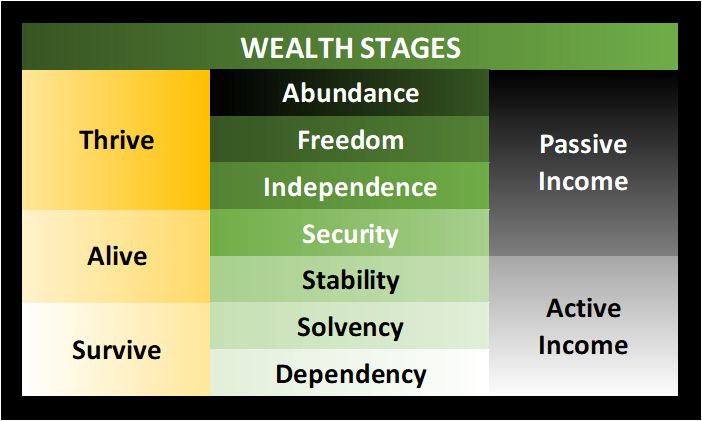

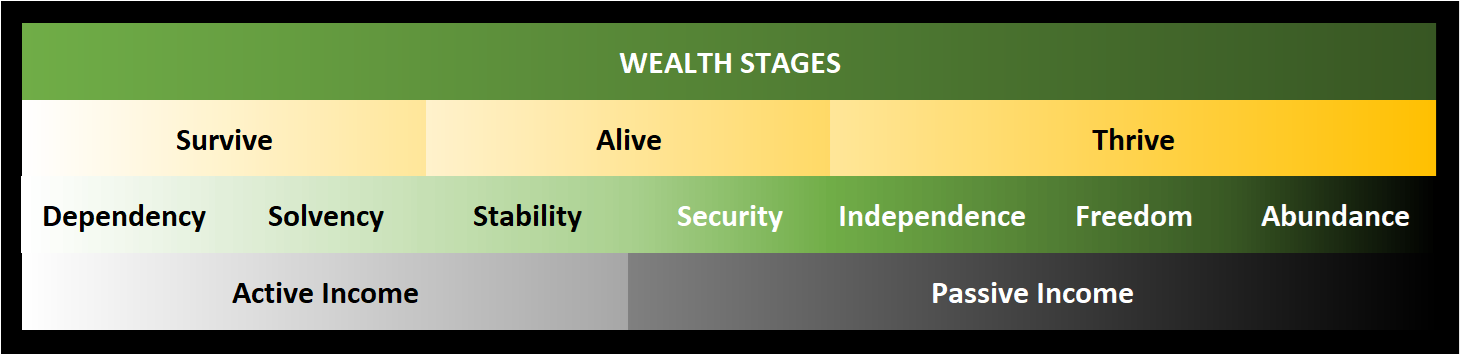

What I came up with were the following 7 stages

I didn’t just pick these out of the blue. They very specifically reflect the progression of moving from active income generation to passive income generation. This progression is also known as moving from “worker” to “investor”. They also very specifically reflect the movement from simply surviving in life, to really being alive and finally to truly thriving.

My end goal is to thrive with abundant wealth generated entirely from passive income.

Wealth Stage Calculation

Below are 5 terms used in calculation of one’s wealth stage. They represent levels of revenues or savings, multiples of which signify moving from one stage to the next. This is what I call my Personal Finance Equations

[RX] Required Expenses = food +shelter + clothing + job expense + min debt payments

[DX] Discretionary Expenses = all other expense – vacation, dining out, charity

[EF] Emergency Fund = cash readily available (<24 hrs)

[AI] Active Income = Income derived from employment

[PI] Passive Income = Income derived from investment without liquidating principal (Net income from real estate after all expenses)

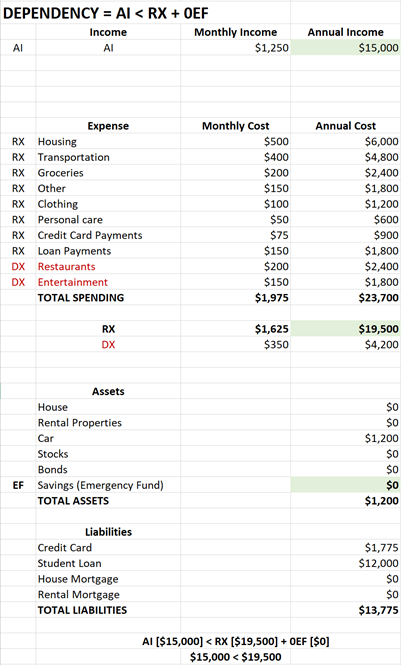

- Dependency = AI < RX + 0EF

- Required Expenses greater than net income

- Emergency fund = 0

- Dependent on others for basic survival needs

- Cash flow negative

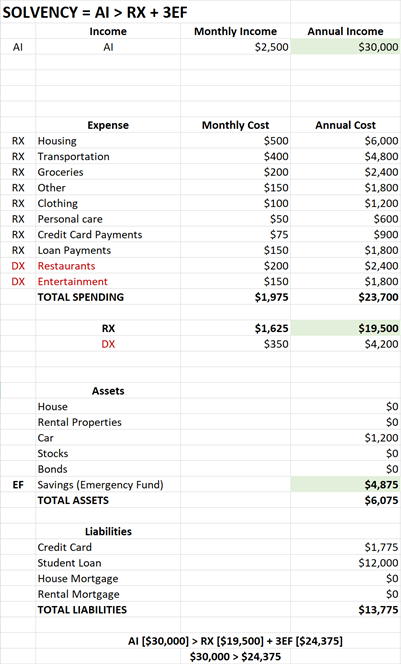

- Solvency = AI > RX + 3EF

- Net income equal to Required Expenses

- Emergency fund = covers 3 months (3EF) of Required Expenses (RX)

- Cash flow neutral, but just barely. Only can cover absolute essentials.

- Stability = AI > RX +DX + 6EF

- Total expenses and emergency fund less than net income

- Emergency fund = covers 6 months (6EF) of Required Expenses (RX)

- Cash flow positive

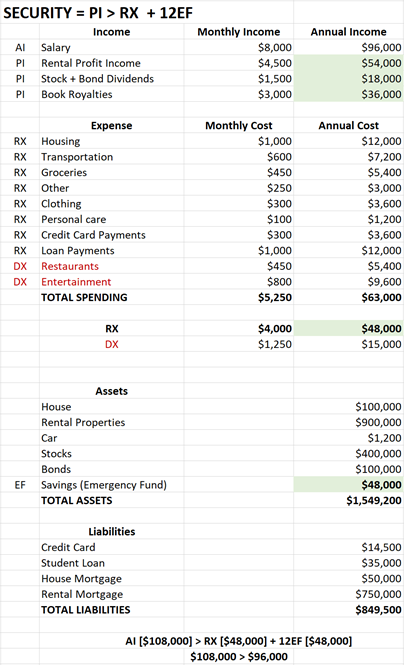

- Security = PI > RX +12EF

- Passive income covers Required Expenses RX

- Emergency fund = covers 12 months (12EF) of Required Expenses (RX)

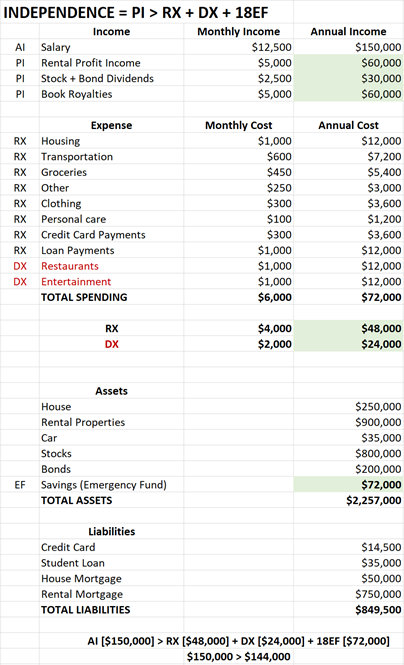

- Independence = PI > RX + DX + 18EF

- Passive income covers total expenses

- Emergency fund = covers 18 months (18EF) of Required Expenses (RX)

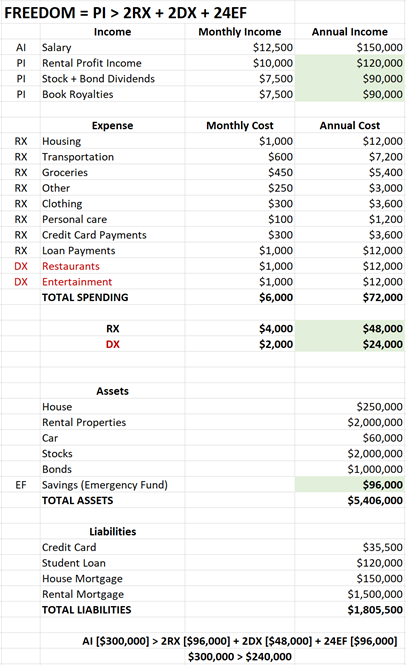

- Freedom = PI > 2RX + 2DX +24EF

- Emergency fund = covers 24 months (24EF) of Required Expenses (RX)

- Debt Free

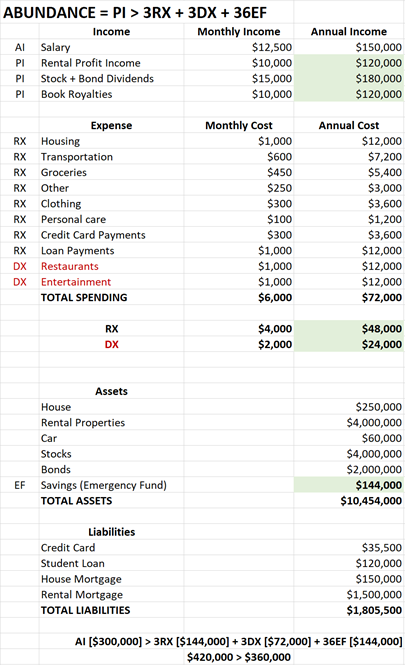

- Abundance = PI > 3RX + 3DX +36EF

- Wealth assets more than enough to lie on and then some using only passive income

- Emergency fund = covers 36+ months (36EF) of Required Expenses (RX)

What you will notice about these stages:

They are definitive

There is an equation for each stage that clearly identifies what levels of income and savings is required to be considered for each wealth stage. It’s not a judgement call. It isn’t some mushy set of qualifications.

They are flexible based on what you consider as required and optional expenses

The larger a life you “choose” to live, the larger the runway to the next stage. The main component of determining your stage is the amount you spend each day, week, month and year. Notice I used the word choose. There are really, very few truly “required” costs. The distinction between dependency, solvency and stability is an important one for this simple distinction between “required” expenses and total expenses.

They are both specific and relative

Allows me to set specific targets while allowing for the variations and relative differences in peoples incomes, expenses, obligations, goals, situations, etc. Being a millionaire has little relevant distinction to someone who spends $250K per year on clothes, cars, dining out and vacations.

They’re customizable based on each individuals desired standard of living

Required expenses excludes “discretionary” expenses, it could also be referred to as “luxury” expenses. Required expense means vastly different things to different people. From living in your car to a 4 bed 5 bath mansion, to somewhere in between, there is one common factor. There are certain set costs associated with ones living expenses. The first step towards wealth is to at a minimum, cover these costs.

I refuse to live on PB&J sandwiches. But I also don’t need to drink Dom Perignon every Friday night. I’ve set a standard and am very comfortable with it. Setting your standard of living and then knowing what it takes to maintain it is critical to the comfort level you have with your plan.

They evolve based on each individual changing situation over time

These stages will vary over a lifetime as you age and move through the various stages of your life. A twenty-year old’s required expenses are obviously expected to differ from a 45-year old’s. Tracking the fluctuations in these levels allows you to set a baseline. Are you spending too much based on your historic trends on optional expenses? How much have your required expenses risen as you’ve bought a house, had children, attended college or moved to different areas of the country with varying costs of living indexes?

They are judgement free

You decide your individual standard of living and thus what it would take to sustain that level throughout retirement or over a lifetime.

Notes about the calculations

Dividends:

I include what potential dividends would be of my retirement accounts for planning purposes as you build towards independent, freedom and abundance. But for the purposes of early retirement, or FIRE decisions, I would exclude accounts that I can’t access until a later age (401K, IRA, etc.)

Freedom vs Independence:

There isn’t that much difference between these two stages. Then again, there is a very big difference. The concept of complete debt elimination.

Independence: Can have debt, if it is covered by passive income.

Freedom: You have completely removed any debt such as mortgage, car or credit card.

Required Expenses:

There is no coincidence that Rx is the sign for prescription. Because minimizing your expenses as much as possible is the prescription for wealth building. Financially successful people limit costs that are not necessary.

Required vs Discretionary Expenses:

All calculations for Expenses (RX & DX) are kept separate. There is not a TX for total expenses, and this is purposeful. You should never look at your expenses as one single entity, but continuously work to break them into compulsory and elective. The discretionary expenses represent your single easiest path to increased cash flow. Need more money? Eat out less. Buy fewer pocketbooks. Buy less beer.

Emergency Fund:

All calculations of emergency funds are based on RX Required Expenses. This assumes during a real emergency, you will decrease or eliminate DX Discretionary Expenses.

Dependency:

I specifically call it this because this financial position is not sustainable without some help from family, friends, or government. It should be of some note that there are many Americans, who are not minors or college students, but still fall into a dependency category. Your first step must be to escape this stage.

Options:

These stages represent my views and values. You may create your own stages or use modified milestone calculations. For example, calculate Passive Income using readily/immediately available assets (exclude those in retirement funds if less than 59.5 and exclude primary residence). Or convert and include all investible assets. Or calculate your emergency fund needs based of both required and discretionary expenses.

Whether you agree with my wealth stages or my milestone calculations, I believe it’s important to utilize some milestone mechanism on your wealth building journey. As with anything I post, ignore it, adjust it, or use it as is. This is just what I do. What do you do? Post to comments.

Examples

I know this is a lot to digest. And I’ll be talking about it in upcoming posts. It is the structure underpinning my entire financial planning process. That’s how important I think this concept is. Do I have something here? What are your thoughts?

5pj7ex

4tj0op

Awesome https://is.gd/N1ikS2

Good https://is.gd/N1ikS2

Good https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

93nssa

Very good partnership https://shorturl.fm/68Y8V

Very good partnership https://shorturl.fm/9fnIC

https://shorturl.fm/FIJkD

https://shorturl.fm/m8ueY

https://shorturl.fm/TbTre

https://shorturl.fm/oYjg5

https://shorturl.fm/9fnIC

https://shorturl.fm/YvSxU

https://shorturl.fm/oYjg5

https://shorturl.fm/6539m

https://shorturl.fm/A5ni8

https://shorturl.fm/m8ueY

https://shorturl.fm/FIJkD

https://shorturl.fm/YvSxU

https://shorturl.fm/TbTre

https://shorturl.fm/bODKa

https://shorturl.fm/N6nl1

5736wp

cspmhe

15i6dt

vkchy2

Drive sales, collect commissions—join our affiliate team! https://shorturl.fm/Mpk0q

Turn traffic into cash—apply to our affiliate program today! https://shorturl.fm/PnUK0

Join our affiliate community and start earning instantly! https://shorturl.fm/Ew6Bl

Join our affiliate program today and earn generous commissions! https://shorturl.fm/vHgBg

Get paid for every referral—enroll in our affiliate program! https://shorturl.fm/zwySS

Monetize your audience—become an affiliate partner now! https://shorturl.fm/5XEb6

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/BdLlg

Grow your income stream—apply to our affiliate program today! https://shorturl.fm/JYM5A

Share your unique link and earn up to 40% commission! https://shorturl.fm/NXibC

Refer friends and colleagues—get paid for every signup! https://shorturl.fm/im49U

Unlock exclusive affiliate perks—register now! https://shorturl.fm/EbAL2

Sign up for our affiliate program and watch your earnings grow! https://shorturl.fm/9BBdy

Refer and earn up to 50% commission—join now! https://shorturl.fm/4opcq

Refer friends, earn cash—sign up now! https://shorturl.fm/NbsJT

Earn recurring commissions with each referral—enroll today! https://shorturl.fm/tGUpQ

Share our offers and watch your wallet grow—become an affiliate! https://shorturl.fm/FWwes

Share your link and rake in rewards—join our affiliate team! https://shorturl.fm/j9pgT

Tap into unlimited earning potential—become our affiliate partner! https://shorturl.fm/ckx2h

Monetize your influence—become an affiliate today! https://shorturl.fm/uUaG3

Promote our products and earn real money—apply today! https://shorturl.fm/DsdFi

Tap into a new revenue stream—become an affiliate partner! https://shorturl.fm/kAZ33

Refer friends and colleagues—get paid for every signup! https://shorturl.fm/dSQjL

Unlock exclusive rewards with every referral—apply to our affiliate program now! https://shorturl.fm/Tabkq

Boost your profits with our affiliate program—apply today! https://shorturl.fm/OFPVn

Invite your network, boost your income—sign up for our affiliate program now! https://shorturl.fm/ErZBv

Become our partner and turn referrals into revenue—join now! https://shorturl.fm/6gTJM

Get started instantly—earn on every referral you make! https://shorturl.fm/EgvP0

Earn passive income on autopilot—become our affiliate! https://shorturl.fm/y7lXN

Share our products, reap the rewards—apply to our affiliate program! https://shorturl.fm/5maVg

Boost your income—enroll in our affiliate program today! https://shorturl.fm/ZBlkR

Apply now and unlock exclusive affiliate rewards! https://shorturl.fm/BsnmF

Tap into unlimited earning potential—become our affiliate partner! https://shorturl.fm/ghJQz

Tap into unlimited earning potential—become our affiliate partner! https://shorturl.fm/oGlae

Unlock top-tier commissions—become our affiliate partner now! https://shorturl.fm/LiTPI

Earn up to 40% commission per sale—join our affiliate program now! https://shorturl.fm/ku1V3

Tap into a new revenue stream—become an affiliate partner! https://shorturl.fm/1FzjM

Drive sales, collect commissions—join our affiliate team! https://shorturl.fm/BuFIS

Earn passive income on autopilot—become our affiliate! https://shorturl.fm/CP6FE

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/6io16

Drive sales, earn big—enroll in our affiliate program! https://shorturl.fm/4UJeO

https://shorturl.fm/napgv

https://shorturl.fm/FlOp8

https://shorturl.fm/Dy1hh

https://shorturl.fm/AXWIb

https://shorturl.fm/t916y

https://shorturl.fm/4ibdy

https://shorturl.fm/TZ3Kx

https://shorturl.fm/nCqW6

https://shorturl.fm/kBRsg

https://shorturl.fm/EgHoM

https://shorturl.fm/HklUS

https://shorturl.fm/8PXvF

https://shorturl.fm/WNbXF

https://shorturl.fm/crL6e

https://shorturl.fm/fyff5

https://shorturl.fm/KTh0C

https://shorturl.fm/3KQua

https://shorturl.fm/1vXKW

https://shorturl.fm/JxEzb

https://shorturl.fm/WV4ud

https://shorturl.fm/DQa8b

https://shorturl.fm/yefgV

https://shorturl.fm/872ip

https://shorturl.fm/12VSJ

https://shorturl.fm/o3Vmv

https://shorturl.fm/eQRQp

https://shorturl.fm/uj5DB

https://shorturl.fm/wGToL

https://shorturl.fm/l7wfH

https://shorturl.fm/e11rQ

https://shorturl.fm/DLdyx

https://shorturl.fm/D4o0g

https://shorturl.fm/TApsA

https://shorturl.fm/us6pn

https://shorturl.fm/WUAhP

https://shorturl.fm/h3xkw

https://shorturl.fm/Ma3Wx

https://shorturl.fm/I3QAO

https://shorturl.fm/QeZrp

https://shorturl.fm/Bjv9E

https://shorturl.fm/t9x9P

https://shorturl.fm/iNm4U

https://shorturl.fm/sX9ej

https://shorturl.fm/LNnoH

https://shorturl.fm/iNDDe

https://shorturl.fm/JGFU6

https://shorturl.fm/jSQj6

https://shorturl.fm/Z7B7Y

https://shorturl.fm/dTmve

https://shorturl.fm/irMMw

https://shorturl.fm/FSpdg

https://shorturl.fm/kX6F0

https://shorturl.fm/nLUET

https://shorturl.fm/4av9G

https://shorturl.fm/E1aeX

https://shorturl.fm/75kmc

https://shorturl.fm/2x0bv

https://shorturl.fm/xGiFk

https://shorturl.fm/pGQGt

https://shorturl.fm/Tue1L

https://shorturl.fm/gUKql

https://shorturl.fm/wzc41

https://shorturl.fm/atBB1

https://shorturl.fm/gqjhR

https://shorturl.fm/lMCO3

https://shorturl.fm/zWg82

https://shorturl.fm/94fv1

https://shorturl.fm/jtITx

https://shorturl.fm/ww6oN

https://shorturl.fm/qE87P

https://shorturl.fm/OTI4r

https://shorturl.fm/sXZ5S

https://shorturl.fm/8k8m8

https://shorturl.fm/8OnsJ

https://shorturl.fm/S1MkT

https://shorturl.fm/0DJaV

https://shorturl.fm/EgfUi

https://shorturl.fm/FXL5u

https://shorturl.fm/eANmg

https://shorturl.fm/YfTBN

https://shorturl.fm/V6BzP

ooj2jk

https://shorturl.fm/7gocA

https://shorturl.fm/M8Ul5

https://shorturl.fm/33YL3

https://shorturl.fm/3j7X4

https://shorturl.fm/1pjb7

https://shorturl.fm/OTifw

https://shorturl.fm/Nz1v4

https://shorturl.fm/FCFJp

https://shorturl.fm/UfwCm

https://shorturl.fm/eMVim

https://shorturl.fm/0tT9p

https://shorturl.fm/nvcby

https://shorturl.fm/XvHV3

https://shorturl.fm/SNEJW

https://shorturl.fm/JKyiM

https://shorturl.fm/lvJfb

bj4wet

https://shorturl.fm/QWO9u

https://shorturl.fm/zEReN

https://shorturl.fm/kxRDa

https://shorturl.fm/IguAf

https://shorturl.fm/tk1Fr

https://shorturl.fm/uiRIw

https://shorturl.fm/x3AnD

https://shorturl.fm/TxnGI

https://shorturl.fm/Iot7D

https://shorturl.fm/dvGmZ

https://shorturl.fm/3FXTe

https://shorturl.fm/oDWIr

Maximize your earnings with top-tier offers—apply now! https://shorturl.fm/JajBV

https://shorturl.fm/4DjWU

https://shorturl.fm/byb2N

https://shorturl.fm/6rLQG

https://shorturl.fm/DGJTn

https://shorturl.fm/pSy18

https://shorturl.fm/Wf8z1

https://shorturl.fm/7TASs

https://shorturl.fm/MBLdk

https://shorturl.fm/DOyyg

https://shorturl.fm/DEgj2

https://shorturl.fm/TUVo1

https://shorturl.fm/cr9r5

https://shorturl.fm/lUakO

https://shorturl.fm/iJzhF

https://shorturl.fm/YQ1IB

https://shorturl.fm/YP2bF

https://shorturl.fm/tDcnl

https://shorturl.fm/N5and

https://shorturl.fm/WOr7u

https://shorturl.fm/S1d7P

https://shorturl.fm/Fb4WX

https://shorturl.fm/LAylZ

https://shorturl.fm/nbIxS

https://shorturl.fm/SNS2r

https://shorturl.fm/dF3hW

https://shorturl.fm/P8Myg

Become our affiliate and watch your wallet grow—apply now!

Monetize your audience with our high-converting offers—apply today!

Tap into unlimited earning potential—become our affiliate partner!

Promote our brand, reap the rewards—apply to our affiliate program today!

Turn your network into income—apply to our affiliate program!

6pn9v7

Join our affiliate community and start earning instantly!

Get paid for every referral—enroll in our affiliate program!

98qlhr

Become our partner and turn clicks into cash—join the affiliate program today!

Share your link, earn rewards—sign up for our affiliate program!

Unlock exclusive affiliate perks—register now!