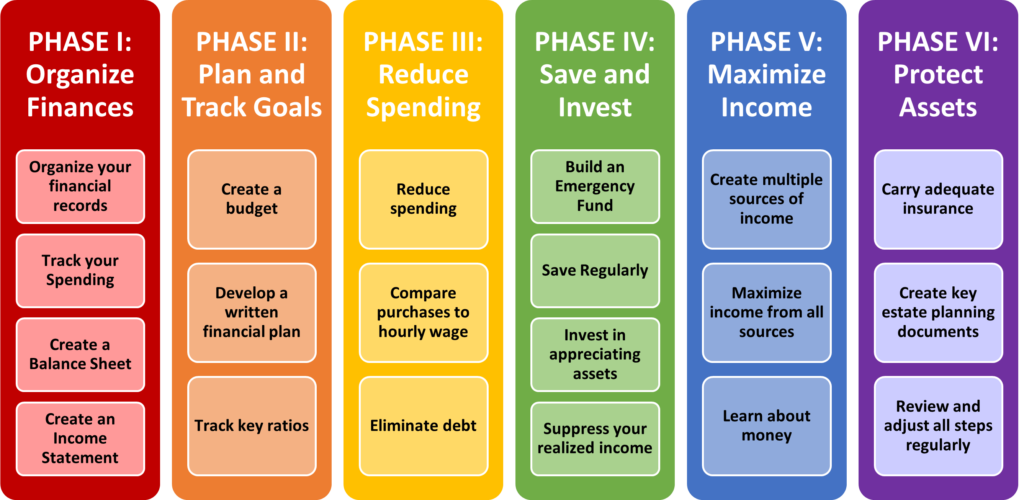

If I was forced to provide you a one sheeter with the most important things you needed to know to manage your finances, I think this would be it. Follow these 20 steps, broken up into 6 distinct phases, and you’ll be OK.

The 6 Phases of Personal Finance

- PHASE I: Organize Finances

- This is the minimum you should do.

- Know where you are before you plan where you’re going.

- PHASE II: Plan and Track

- It is astonishing how few Americans have a clearly thought out written financial plan

- Create a structured financial plan

- PHASE III: Reduce Spending

- Controlling spending is critical to financial success

- PHASE IV: Save and Invest

- Investing is almost the last of the steps in the process

- PHASE V: Maximize Income

- Work to increase sources of income

- Work to maximize income from all sources

- PHASE VI: Protect Assets

- insurance and estate planning is critical to ensuring your money goes where you expect

The 20 Steps of Personal Finance

- Organize your financial records (paper or electronic). Set up a system for filing financial documents

- Track your Spending Knowing & tracking what you spend money on is the first step to controlling your expenses. Track for a minimum 90 days. Determine your total earnings and monthly expenses.

- Create a Balance Sheet to track your net worth.

- Create an Income Statement to track cash flow

Plan and Track

- Create a Budget (CAP = Capital Accumulation Plan)

- Develop a written financial plan. (Long Term) Determine what you will do in retirement. Determine other major life goals and events. Build plan to manage, achieve and succeed.

- Track Key Financial Ratios Use Financial ratios (such as Savings Ratio and True Hourly Wage) to track progress and compare your progress to others in general and in your cohort.

Reduces Spending

- Reduce Spending (Minimize Expenses) Live below your means. Learn to want less. Spend less than you earn. Be ruthless in cutting.

- Compare Purchases to True Hourly Wage – Tax and Location Adjusted That’s how much you could actually sell an hour of your time for.

- Eliminate Debt (Minimize Liabilities) Limit or eliminate borrowing of any kind. Get and stay out of debt.

Save and Invest

- Build an Emergency Fund Your emergency fund should cover at least 3 to 6 months living expenses to begin with and possibly more depending on your job security.

- Save Regularly Regular saving is the key to a successful retirement. Do it early and often.

- Invest savings in appreciating assets Stocks & bonds. Real estate. Small business. Invest aggressively to beat inflation. Start early. Invest for the long term. Minimize fees and taxes.

- Suppress your realized income Divert earned income to pre-tax investment accounts and grow your unrealized income.

Maximize Income

- Create multiple sources of income Focus on building passive income streams

- Maximize income from all sources

- Learn about money Start talking about money. Educate yourself. Read books and blogs. Take classes. Listen to podcasts. Talk to successful individuals.

Protect Assets

- Carry adequate insurance Protect every asset meticulously. They are hard enough to collect.

- Create key estate planning documents Ensure your wealth is transferred to those you wish, in the manner you wish, with minimum cost.

- Review and adjust all steps regularly For the rest of your life.

Leave a Reply