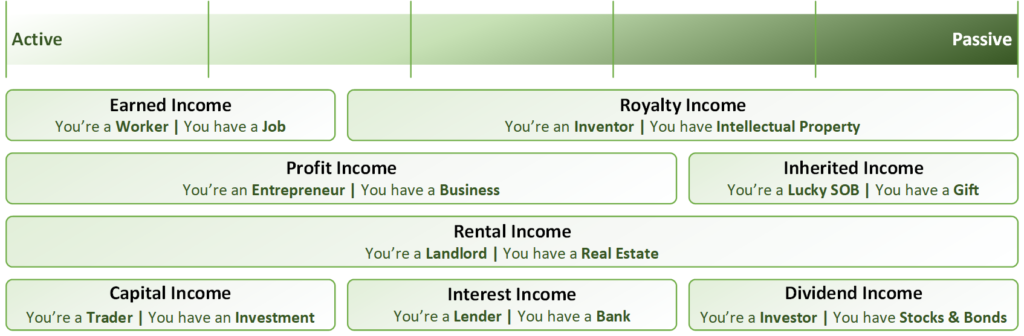

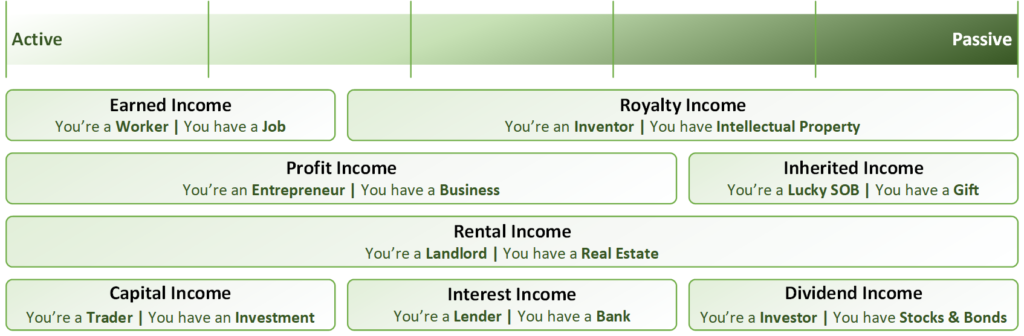

The IRS breaks income into three types – earned, portfolio and passive. However, that is too simplistic for our purposes. If broken down not based on IRS qualifications, but by how the income is derived from the perspective of your activity to generate it, we have 7 types of income.

Earned Income | You are a Worker | You have a Job Profit Income | You are an Entrepreneur | You have a Business Interest Income | You are a Lender | You have a Bank Dividend Income | You are an Investor | You have a Stock or Bond Rental Income | You are a Landlord | You have a Real Estate property Royalty Income | You are an Inventor | You have Intellectual Property Capital Income | You are a Trader | You have all of the above Inherited Income | You are a Lucky SOB | You have a Gift

Most wealthy individuals obtain income from more than one source and typically several. Thus, it’s a generally good idea to cultivate multiple sources of income across these eight categories. Each has benefits and drawbacks.

Time Horizon:

- Short term equals income realized in less than 1 year

- Long term is income realized greater than 1 year

What makes one better than another?

Hard Criteria (investment criteria)

- Risk: Likelihood of losing principal investment (or more)

- Passivity: Amount of work (or lack thereof) required to realize profit

- Feasibility: Ability for any reasonable person to execute the investment

- Liquidity: Ability to withdraw your investment and without penalty

- Return: Ability to provide returns in excess of the risk-free rate

Soft Criteria (investor criteria)

- Passion: How much do you (or need to) love to do this type of work

- Expertise: How much specialized knowledge do you have (or is needed)

- Patience: Amount of tolerance for delay, trouble, or suffering

- Diversity: How varied a skill level do you need to be successful

- Commitment: Level of dedication you have (or is needed)

- Earned IncomeWorker | Job

- Trading your time for money

- Less risk, more comfort

- Profit IncomeEntrepreneur | Business

- Selling something for more than it costs you to produce

- Difficult lifestyle, lots of hard work

- More risk, less comfort

- Tax benefits

- May or may not require significant capital outlays

- Long term hold strategy

- Interest IncomeLender |Bank

- Lending your money to someone else

- Examples:

- Peer to Peer (P2P) investing

- CD / Money Market

- Bonds

- Long term hold strategy

- Easier to do today with Micro lending platforms

- Dividend IncomeInvestor | Stock

- Money that you get as a return on shares of a company you own

- Does not require significant initial capital outlays

- Typically, stocks, but can be bonds or other instruments

- Stocks

- Mutual funds

- ETFs

- Rental IncomeLandlord | Real Estate Property

- Renting out an asset that you have, like a house, or a building

- Apartments

- Houses

- Boats

- Cars

- Machinery

- Typically requires significant initial capital outlays

- Capital outlays can be significantly leveraged with minimized risk

- Relatively illiquid

- Long term hold strategy

- Renting out an asset that you have, like a house, or a building

- Royalty IncomeInventor | Intellectual Property

- Letting someone use your products, ideas, or processes.

- Patents

- Franchise

- Book publishing

- Music publishing

- Challenge to create something unique yet repeatable. Need special skills to create such an asset

- Once created, there is virtually no limit to the money you can earn

- Long term hold strategy

- Letting someone use your products, ideas, or processes.

- Capital IncomeTrader | all of the above

- Selling something for more than you bought it

- Examples

- Real Estate (foreclosure and flips)

- Business

- Machinery

- Other items

- Short term flip strategy

- Inherited IncomeLuck SOB | Gift

- While most people only dream of inheriting “wealth”, it is a very real method of attaining wealth for some lucky folks out there.

Good https://lc.cx/xjXBQT

Good https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

https://shorturl.fm/N6nl1

https://shorturl.fm/m8ueY

https://shorturl.fm/5JO3e

https://shorturl.fm/oYjg5

https://shorturl.fm/9fnIC

https://shorturl.fm/j3kEj

https://shorturl.fm/TbTre

https://shorturl.fm/XIZGD

https://shorturl.fm/XIZGD

https://shorturl.fm/N6nl1

https://shorturl.fm/9fnIC

https://shorturl.fm/5JO3e

https://shorturl.fm/YvSxU

https://shorturl.fm/FIJkD

1gkuog

7rq73b

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/OjFYi

Promote our brand, reap the rewards—apply to our affiliate program today! https://shorturl.fm/vU47N

Partner with us for generous payouts—sign up today! https://shorturl.fm/c1UPp

Get started instantly—earn on every referral you make! https://shorturl.fm/RsbDT

Promote, refer, earn—join our affiliate program now! https://shorturl.fm/D8BjN

Join our affiliate program today and earn generous commissions! https://shorturl.fm/Afd4r

Earn passive income on autopilot—become our affiliate! https://shorturl.fm/i76r0

Monetize your audience—become an affiliate partner now! https://shorturl.fm/EdNuf

Become our affiliate and watch your wallet grow—apply now! https://shorturl.fm/LMnk3

Start profiting from your traffic—sign up today! https://shorturl.fm/rN5bd

Start sharing our link and start earning today! https://shorturl.fm/BN3p4

Turn your network into income—apply to our affiliate program! https://shorturl.fm/1fhB1

Start earning every time someone clicks—join now! https://shorturl.fm/byZhr

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/R1vSm

Join our affiliate community and maximize your profits! https://shorturl.fm/Wezyh

Boost your income—enroll in our affiliate program today! https://shorturl.fm/8wykh

Share our products and watch your earnings grow—join our affiliate program! https://shorturl.fm/i4Neg

Earn up to 40% commission per sale—join our affiliate program now! https://shorturl.fm/2cU0Y

Turn referrals into revenue—sign up for our affiliate program today! https://shorturl.fm/FFfdG

Grow your income stream—apply to our affiliate program today! https://shorturl.fm/ASKOA

Drive sales, earn commissions—apply now! https://shorturl.fm/SZfXa

Monetize your traffic instantly—enroll in our affiliate network! https://shorturl.fm/bViwD

Join our affiliate program and watch your earnings skyrocket—sign up now! https://shorturl.fm/yog0V

Monetize your audience—become an affiliate partner now! https://shorturl.fm/Ph1Qw

Drive sales, collect commissions—join our affiliate team! https://shorturl.fm/rKlRf

Share our products, reap the rewards—apply to our affiliate program! https://shorturl.fm/QsZkU

Turn your traffic into cash—join our affiliate program! https://shorturl.fm/JRaLW

Sign up and turn your connections into cash—join our affiliate program! https://shorturl.fm/xug5n

Promote our brand and get paid—enroll in our affiliate program! https://shorturl.fm/f6JkF

Unlock top-tier commissions—become our affiliate partner now! https://shorturl.fm/fEHXZ

Join our affiliate community and earn more—register now! https://shorturl.fm/jS0zr

Get rewarded for every recommendation—join our affiliate network! https://shorturl.fm/DkujI

Sign up now and access top-converting affiliate offers! https://shorturl.fm/QhKdR

Monetize your audience—become an affiliate partner now! https://shorturl.fm/Jz8VY

Monetize your traffic instantly—enroll in our affiliate network! https://shorturl.fm/DSe6A

Your network, your earnings—apply to our affiliate program now! https://shorturl.fm/ZyPgt

Start sharing our link and start earning today! https://shorturl.fm/833N2

Tap into unlimited earnings—sign up for our affiliate program! https://shorturl.fm/UOupU

Share our products and watch your earnings grow—join our affiliate program! https://shorturl.fm/NUwQA

uqgmas

Drive sales, earn commissions—apply now! https://shorturl.fm/2Rcvv

Refer friends, earn cash—sign up now! https://shorturl.fm/cP3AM

Become our affiliate—tap into unlimited earning potential! https://shorturl.fm/TE8TW

https://shorturl.fm/uNKuI

https://shorturl.fm/8rAQd

https://shorturl.fm/8eAdm

https://shorturl.fm/t916y

https://shorturl.fm/bEdGO

https://shorturl.fm/TgYci

https://shorturl.fm/r9O4W

https://shorturl.fm/nCqW6

https://shorturl.fm/etGNu

https://shorturl.fm/DwYxy

https://shorturl.fm/9rQjj

https://shorturl.fm/yWTva

https://shorturl.fm/tPPpn

https://shorturl.fm/C1311

https://shorturl.fm/7WDeo

https://shorturl.fm/A84FN

https://shorturl.fm/2b3PC

https://shorturl.fm/Ln4dH

https://shorturl.fm/VdUD3

https://shorturl.fm/Py7Oc

https://shorturl.fm/VELGF

https://shorturl.fm/cdMEL

https://shorturl.fm/WQxDd

https://shorturl.fm/bwmBQ

https://shorturl.fm/ik4H3

https://shorturl.fm/ADN2M

https://shorturl.fm/XFKIU

https://shorturl.fm/7jIdh

https://shorturl.fm/IxnCz

https://shorturl.fm/Z07gP

https://shorturl.fm/v94mw

https://shorturl.fm/fvfEz

https://shorturl.fm/Va0JN

https://shorturl.fm/4pEYT

https://shorturl.fm/8uJiP

https://shorturl.fm/tglD0

https://shorturl.fm/Nhx2f

https://shorturl.fm/hjUpK

https://shorturl.fm/I3QAO

https://shorturl.fm/LBqlW

https://shorturl.fm/W8mlb

https://shorturl.fm/oKWo7

https://shorturl.fm/lKLCO

https://shorturl.fm/hAqR9

https://shorturl.fm/FE5Vt

https://shorturl.fm/FE5Vt

https://shorturl.fm/0wUla

https://shorturl.fm/6wMq8

https://shorturl.fm/VmuGh

https://shorturl.fm/msXWO

https://shorturl.fm/oNkLS

https://shorturl.fm/Kbeba

tueaqn

https://shorturl.fm/9FHK6

https://shorturl.fm/vhdj6

https://shorturl.fm/CPMi9

https://shorturl.fm/bOGOe

https://shorturl.fm/B2GkQ

ekujl1

https://shorturl.fm/SMF8W

https://shorturl.fm/r45Nd

https://shorturl.fm/yc8KJ

https://shorturl.fm/c9SrO

https://shorturl.fm/Chis9

https://shorturl.fm/Zl6ia

https://shorturl.fm/mXbJO

https://shorturl.fm/kjTMB

https://shorturl.fm/KdR1o

https://shorturl.fm/9brkO

https://shorturl.fm/01mCs

https://shorturl.fm/6pr7Q

https://shorturl.fm/F0Egl

https://shorturl.fm/kI6YD

https://shorturl.fm/YDr6t

03vy5u

https://shorturl.fm/DedYC

https://shorturl.fm/Lv0Mf

https://shorturl.fm/jfNYo

https://shorturl.fm/c11M6

https://shorturl.fm/c4ZFw

Monetize your traffic instantly—enroll in our affiliate network! https://shorturl.fm/AaFLw

https://shorturl.fm/XHY4h

https://shorturl.fm/lCaV1

https://shorturl.fm/8iDB0

https://shorturl.fm/wulPa

r7cimc

https://shorturl.fm/Aqqwz

https://shorturl.fm/KTKEB

https://shorturl.fm/wsEs5

https://shorturl.fm/WvS9v

https://shorturl.fm/v6p85

https://shorturl.fm/Pl9K6

https://shorturl.fm/1qClp

https://shorturl.fm/Z19C0

https://shorturl.fm/SNS2r

https://shorturl.fm/GlZUE

https://shorturl.fm/W4vaR

Partner with us for generous payouts—sign up today!

Start sharing our link and start earning today!

Partner with us and earn recurring commissions—join the affiliate program!

Invite your network, boost your income—sign up for our affiliate program now!