The geometric mean is the average of a set of numbers by using the product of their values, as opposed to using the sum, as in the arithmetic mean. The value of this method of calculating average can be seen commonly when calculating the performance of an investment or portfolio.

Technically, it is “the nth root product of n numbers.”

Generally speaking, you use the geometric mean when working with percentages, while using standard arithmetic mean when working with individual values.

One of the biggest reasons to use this method of “averaging” when looking at portfolio performance is that it considers the effects of compounding. Simply using the arithmetic mean will not provide your correct performance numbers.

The geometric mean is also called the compounded annual growth rate or time-weighted rate of return.

Geometric Mean Formula

μ geometric =[(1+R1 )(1+R2 )…(1+Rn )]1/n −1

where: R1 …Rn are the returns of an asset (or other observations for averaging).

Geometric Mean Example:

Suppose you have a $1,000 investment that pays 10% every year for 30 years on the balance in the account at the end of the year. In other words, the investor is getting paid interest on the interest – also known as “Compound Interest.”

Year 1 Interest = $100 ($1,000 x 10%) New Principal amount = $1,100

Year 2 Interest = $100 ($1,100 x 10%)

In this case

calculate the interest in year one, which is $10,000 multiplied by 10%, or $1,000. In year two, the new principal amount is $11,000, and 10% of $11,000 is $1,100. The new principal amount is now $11,000 plus $1,100, or $12,100.

In year three, the new principal amount is $12,100, and 10% of $12,100 is $1,210. At the end of 25 years, the $10,000 turns into $108,347.06, which is $98,347.05 more than the original investment. The shortcut is to multiply the current principal by one plus the interest rate, and then raise the factor to the number of years compounded. The calculation is $10,000 × (1+0.1) 25 = $108,347.06.

For example, the geometric mean calculation can be easily understood with simple numbers, such as 2 and 8. If you multiply 2 and 8, then take the square root (the ½ power since there are only 2 numbers), the answer is 4. However, when there are many numbers, it is more difficult to calculate unless a calculator or computer program is used.

The longer the time horizon, the more critical compounding becomes and the more appropriate the use of geometric mean.

The main benefit of using the geometric mean is the actual amounts invested do not need to be known; the calculation focuses entirely on the return figures themselves and presents an “apples-to-apples” comparison when looking at two investment options over more than one time period. Geometric means will always be slightly smaller than the arithmetic mean, which is a simple average.

Key Takeaways

- The geometric mean is the average rate of return of a set of values calculated using the products of the terms.

- It is most appropriate for series that exhibit serial correlation. This is especially true for investment portfolios.

- Most returns in finance are correlated, including yields on bonds, stock returns, and market risk premiums.

- For volatile numbers, the geometric average provides a far more accurate measurement of the true return by taking into account year-over-year compounding that smooths the average.

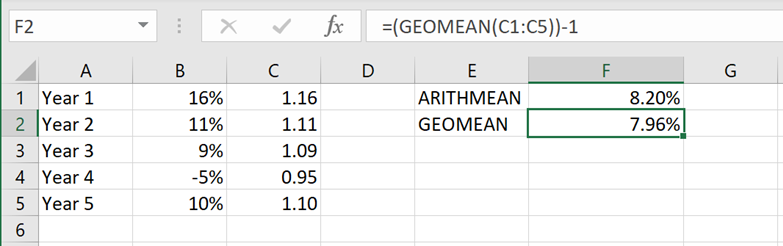

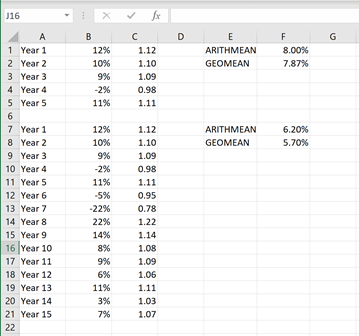

Excel Syntax

=GEOMEAN (number1, [number2], …)

Arguments

number1 – First value or reference.

number2 – [optional] Second value or reference.

Example of Geometric Mean

If you have $10,000 and get paid 10% interest on that $10,000 every year for 25 years, the amount of interest is $1,000 every year for 25 years, or $25,000. However, this does not take the interest into consideration. That is, the calculation assumes you only get paid interest on the original $10,000, not the $1,000 added to it every year. If the investor gets paid interest on the interest, it is referred to as compounding interest, which is calculated using the geometric mean.

Using the geometric mean allows analysts to calculate the return on an investment that gets paid interest on interest. This is one reason portfolio managers advise clients to reinvest dividends and earnings.

The geometric mean is also used for present value and future value cash flow formulas. The geometric mean return is specifically used for investments that offer a compounding return. Going back to the example above, instead of only making $25,000 on a simple interest investment, the investor makes $108,347.06 on a compounding interest investment. Simple interest or return is represented by the arithmetic mean, while compounding interest or return is represented by the geometric mean.

Arithmetic Versus Geometric Mean

Look. Do you HAVE to use this? Of course not. I think it’s a great tool to compare against the ‘regular’ mean average. As you can see from the examples above, the geometric mean is sufficiently different to matter when you are looking at performance of an investment. Just another tool in the toolbox!

5cfu7y

ej3xqb

Good https://shorturl.at/2breu

Good https://t.ly/tndaA

Good https://rb.gy/4gq2o4

Awesome https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

nzwhhw

https://shorturl.fm/bODKa

https://shorturl.fm/TbTre

https://shorturl.fm/oYjg5

https://shorturl.fm/TbTre

https://shorturl.fm/m8ueY

https://shorturl.fm/YvSxU

This seems like an inspiring approach to self-improvement. Combining fun with learning is a great way to stay motivated. Helping others while helping yourself creates a positive cycle. It’s interesting to see how small steps can lead to big changes. How do you plan to track your progress along the way? I’m curious about what challenges you might face and how you’ll overcome them. Would you say this mindset has already made a difference in your life?

https://shorturl.fm/FIJkD

https://shorturl.fm/N6nl1

https://shorturl.fm/FIJkD

https://shorturl.fm/TbTre

https://shorturl.fm/oYjg5

https://shorturl.fm/5JO3e

https://shorturl.fm/9fnIC

https://shorturl.fm/68Y8V

hem08e

ybssbn

hgnsx4

Earn passive income on autopilot—become our affiliate! https://shorturl.fm/B8bf4

Promote, refer, earn—join our affiliate program now! https://shorturl.fm/v1h60

Join our affiliate program and watch your earnings skyrocket—sign up now! https://shorturl.fm/O95oe

Join our affiliate community and start earning instantly! https://shorturl.fm/0QwHJ

Get paid for every click—join our affiliate network now! https://shorturl.fm/cAJQn

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/r8NGd

Apply now and receive dedicated support for affiliates! https://shorturl.fm/I8Fbh

Start sharing our link and start earning today! https://shorturl.fm/hRM3J

Earn passive income this month—become an affiliate partner and get paid! https://shorturl.fm/7h7KO

Share your unique link and earn up to 40% commission! https://shorturl.fm/NXibC

Start profiting from your traffic—sign up today! https://shorturl.fm/rN5bd

Boost your profits with our affiliate program—apply today! https://shorturl.fm/QjzcF

Refer friends, earn cash—sign up now! https://shorturl.fm/NbsJT

Start earning instantly—become our affiliate and earn on every sale! https://shorturl.fm/wyh4E

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/eSdnY

Tap into a new revenue stream—become an affiliate partner! https://shorturl.fm/xNF44

Share our link, earn real money—signup for our affiliate program! https://shorturl.fm/JExEr

Your influence, your income—join our affiliate network today! https://shorturl.fm/CIU9A

Share your unique link and cash in—join now! https://shorturl.fm/dSruV

Monetize your traffic instantly—enroll in our affiliate network! https://shorturl.fm/bViwD

Become our partner and turn referrals into revenue—join now! https://shorturl.fm/YuHsh

Sign up and turn your connections into cash—join our affiliate program! https://shorturl.fm/vrrcJ

Refer friends, collect commissions—sign up now! https://shorturl.fm/cuKLT

Tap into unlimited earnings—sign up for our affiliate program! https://shorturl.fm/0nrVX

Turn your network into income—apply to our affiliate program! https://shorturl.fm/bjLJl

Join our affiliate program and start earning today—sign up now! https://shorturl.fm/fMfI9

Get paid for every referral—enroll in our affiliate program! https://shorturl.fm/TeBJV

Refer customers, collect commissions—join our affiliate program! https://shorturl.fm/hsPa1

Earn passive income on autopilot—become our affiliate! https://shorturl.fm/FESkn

Sign up for our affiliate program and watch your earnings grow! https://shorturl.fm/XdjLO

Unlock top-tier commissions—become our affiliate partner now! https://shorturl.fm/LiTPI

Earn up to 40% commission per sale—join our affiliate program now! https://shorturl.fm/ku1V3

Apply now and receive dedicated support for affiliates! https://shorturl.fm/XmV5u

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/asitA

Promote our products—get paid for every sale you generate! https://shorturl.fm/AiA52

Tap into unlimited earnings—sign up for our affiliate program! https://shorturl.fm/7Bcoe

Join forces with us and profit from every click! https://shorturl.fm/UPnTs

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/CAvk7

Refer and earn up to 50% commission—join now! https://shorturl.fm/BPxoP

Share our products, reap the rewards—apply to our affiliate program! https://shorturl.fm/6aKl3

https://shorturl.fm/CJ1ue

https://shorturl.fm/Z5GwS

https://shorturl.fm/FGkOZ

https://shorturl.fm/bEdGO

https://shorturl.fm/TF4Kg

https://shorturl.fm/7Bhaj

https://shorturl.fm/4URby

https://shorturl.fm/kNXNF

https://shorturl.fm/mc1qC

https://shorturl.fm/d3kjm

https://shorturl.fm/Uab9v

https://shorturl.fm/Bs9yl

https://shorturl.fm/gfW9u

https://shorturl.fm/lrdQN

https://shorturl.fm/Kok31

https://shorturl.fm/4ndpt

https://shorturl.fm/rnNYz

https://shorturl.fm/RkkR5

https://shorturl.fm/xM2YX

https://shorturl.fm/zmEXM

https://shorturl.fm/DQa8b

https://shorturl.fm/IUaOu

https://shorturl.fm/37Cgg

https://shorturl.fm/lczXS

https://shorturl.fm/rCitB

https://shorturl.fm/KrXO4

https://shorturl.fm/3T6AW

https://shorturl.fm/fBF9S

https://shorturl.fm/NUggB

https://shorturl.fm/pKNoF

https://shorturl.fm/HqPK1

https://shorturl.fm/fvfEz

https://shorturl.fm/lASEy

https://shorturl.fm/Me9FA

https://shorturl.fm/mUcIV

https://shorturl.fm/s1BDm

https://shorturl.fm/HH3Fz

https://shorturl.fm/0fOl9

https://shorturl.fm/cVoXn

https://shorturl.fm/TKKX7

https://shorturl.fm/DDThi

https://shorturl.fm/caXkH

https://shorturl.fm/yEsYe

https://shorturl.fm/y7Fxs

https://shorturl.fm/QeZrp

https://shorturl.fm/12sVw

https://shorturl.fm/Uu3Lr

https://shorturl.fm/jHmYj

https://shorturl.fm/Yc9ht

https://shorturl.fm/iicvO

https://shorturl.fm/ykvxP

https://shorturl.fm/ZrotU

https://shorturl.fm/hutJt

https://shorturl.fm/r4Xk1

https://shorturl.fm/MhPe7

https://shorturl.fm/oNkLS

levitra online ireland levitra rezeptfrei levitrade2022 levitra user ratings

https://shorturl.fm/h7ueB

yxdojd

https://shorturl.fm/Y8kLF

https://shorturl.fm/JwcwH

https://shorturl.fm/Q3ULn

https://shorturl.fm/h3ckO

https://shorturl.fm/y0Zjy

https://shorturl.fm/Oxknz

https://shorturl.fm/zdyAk

https://shorturl.fm/2EWfu

https://shorturl.fm/MvaBp

https://shorturl.fm/wPagG

https://shorturl.fm/Qrm18

https://shorturl.fm/1hxf9

https://shorturl.fm/SLmvt

https://shorturl.fm/EGT8s

https://shorturl.fm/wORPt

https://shorturl.fm/ykFlQ

https://shorturl.fm/FDv4r

https://shorturl.fm/lsqJr

https://shorturl.fm/z2wLI

https://shorturl.fm/9SuB2

https://shorturl.fm/IkIEO

https://shorturl.fm/f6KFb

https://shorturl.fm/VhfuD

https://shorturl.fm/CL4H0

https://shorturl.fm/8j1Xi

https://shorturl.fm/RRVmj

https://shorturl.fm/OUmeh

https://shorturl.fm/fgSlZ

https://shorturl.fm/AeZAN

https://shorturl.fm/TfXGc

4g81gu

https://shorturl.fm/ajnHR

https://shorturl.fm/gVHbT

https://shorturl.fm/coVOi

https://shorturl.fm/8yWqQ

https://shorturl.fm/J2JQl

https://shorturl.fm/ZNGNT

https://shorturl.fm/OSGBw

https://shorturl.fm/YKkMF

https://shorturl.fm/1GYXv

https://shorturl.fm/fja3M

https://shorturl.fm/3u6n3

https://shorturl.fm/LsRlJ

https://shorturl.fm/Fm3IR

https://shorturl.fm/M4OL0

https://shorturl.fm/tKz6K

https://shorturl.fm/ya8ZW

https://shorturl.fm/STJSj

https://shorturl.fm/eTGGK

https://shorturl.fm/5eP6M

https://shorturl.fm/SIvqZ

https://shorturl.fm/RrH44

https://shorturl.fm/iEsH4

https://shorturl.fm/ESpjT

https://shorturl.fm/ESpjT

https://shorturl.fm/wFBMh

iakxdb

https://shorturl.fm/YvIPf

https://shorturl.fm/NVTwv

https://shorturl.fm/1r3XO

kxrouf

https://shorturl.fm/WCrhd

https://shorturl.fm/Lo5gk

https://shorturl.fm/iVHaC

https://shorturl.fm/P03dm

https://shorturl.fm/RhGLg

https://shorturl.fm/rPbHf

https://shorturl.fm/4h47v

https://shorturl.fm/1egbw

https://shorturl.fm/9D9pX

https://shorturl.fm/21F31

https://shorturl.fm/xIxNG

https://shorturl.fm/uf9oX

https://shorturl.fm/vcJEY

https://shorturl.fm/XqZ12

https://shorturl.fm/OVgly

https://shorturl.fm/loe5v

https://shorturl.fm/Purkv

https://shorturl.fm/xe4G4

https://shorturl.fm/FVoyx

https://shorturl.fm/4eXVp

https://shorturl.fm/yPVF7

https://shorturl.fm/Hmu1Y

https://shorturl.fm/xCOSv

Earn your airdrop on Aster https://is.gd/ZceEI6

Fast indexing of website pages and backlinks on Google https://is.gd/r7kPlC

Hi https://is.gd/9PLRLO

xdt6ji

Become our affiliate—tap into unlimited earning potential!

Join our affiliate program and start earning commissions today—sign up now!

Get paid for every click—join our affiliate network now!

Boost your earnings effortlessly—become our affiliate!

Refer friends, collect commissions—sign up now!

Become our partner and turn referrals into revenue—join now!

Tap into unlimited earning potential—become our affiliate partner!